سرویس خبر : معادن و مواد معدنی

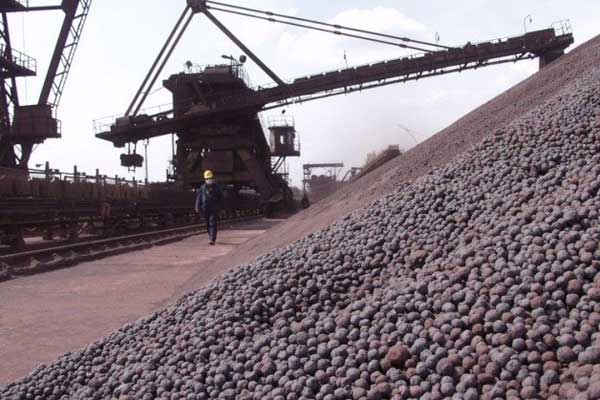

کاهش تولید و صادرات دومین تولید کننده سنگ آهن دنیا

می متالز - شرکت معدنی ریو تینتو که دومین تولید کننده بزرگ سنگ آهن دنیاست از کاهش تولید و فروش سنگ آهن خود در سه ماه نخست سال خبر داد که به دلیل شرایط بد آب و هوایی در استرالیا بود.

بین ژانویه تا مارس این شرکت 76.7 میلیون تن سنگ آهن صادر کرد که 13 درصد نسبت به سه ماهه چهارم سال 2016 افت داشت ولی نسبتا مشابه فصل اول سال گذشته بود. تولید 77.2 میلیون تن بود که 3 درصد نسبت به سال قبل و 10 درصد نسبت به فصل گذشته افت داشت که به دلیل اختلال در فعالیت این شرکت در زمان سیل و طوفان در استرالیا بود.

هدف تولید امسال این شرکت نیز تغییر نکرده 330 تا 340 میلیون تن اعلام شده است.

منبع: ایفنا

عناوین برگزیده

بیست ویک ساعت پیش

بیست و سه ساعت پیش

یک روز پیش

مدیرعامل شرکت سرمایهگذاری توسعه معادن و فلزات عنوان کرد:

افتتاح نخستین طرح پیشران اقتصادی با سرمایهگذاری "ومعادن"/ سرمایهگذاری ۳.۵ میلیارد دلاری "ومعادن"

افتتاح بزرگترین کارخانه فروسیلیس ایران در دامغان طی سفر دولت سیزدهم

طلای جهانی از تکاپو افتاد

بازار طلای جهانی اندکی سرد شد

درج شرکت آلیاژ گستر هامون در بازار دوم فرابورس ایران

تغییرات مدیریتی با تمرکز بر اهداف فنی و توسعهای/ فسادستیزی اساس کار در ایمیدرو است

ارزش سهام شرکت فولاد اقلید ۴ برابر شد

صنعت فولاد ایران هدف جدیدترین تحریمهای آمریکا

ساخت ابر پروژه فولاد استان همدان با ۳۰ هزار میلیارد ریال سرمایهگذاری

موثقینیا:

تحقق جهش تولید مورد نظر رهبری در بخش معدن، آثار مستقیمی در توسعه اقتصاد دارد

مشتریان مقاطع طویل، دست از خرید کشیدند

خزان معاملات میلگرد در بازار فیزیکی

۲۰۲۴ سالی آرام برای بازار جهانی فولاد

توسعه معدن در گرو ایجاد زیرساخت

فولاد چین در تجارت جهانی پررنگ شد

نحوه محاسبه عملکرد معادن چالش معدنکاران زنجان

ظرفیت ارزش افزوده معدن در جنوب کرمان ۱۰ برابر بیشتر از کشاورزی است

افزایش قابل توجه صادرات مواد معدنی ترکیه پس از اقدامات انجمن صادرکنندگان مواد معدنی دریای اژه

آیا رشد آهسته دلار نیمایی، ضامن رشد بازار خواهد شد؟

محرک جدید بورس

نبض مسکن تبریز شبیه اصفهان یا مشهد؟

«تجلی» همچنان بر مدار توسعه/ آخرین خبرها از اولین شرکت پروژهمحور بورس

وزیر صمت: شورای رقابت مسوول قیمت پژوپارس است

افزایش قابل توجه صادرات مواد معدنی ترکیه پس از اقدامات انجمن صادرکنندگان مواد معدنی دریای اژه

شتابدهندههای قیمت طلای جهانی کداماند؟/ اثر عوامل سیاسی و اقتصادی بر رشد فلز زرد

طلای جهانی از تکاپو افتاد

جزئیات پیشرفت پروژه عظیم مجتمع مس جانجا اعلام شد

افتتاح نخستین طرح پیشران اقتصادی کشور با سرمایهگذاری «ومعادن»

ضرورت جذب سرمایهگذاری مالی و مشارکت مردمی برای توسعه معادن

همراهی بانکها در تامین مالی پروژهها و طرحهای توسعه شرکت مس