سرویس خبر : معادن و مواد معدنی

سنگ آهن ماه گذشته 18 دلار افت داشت

می متالز - با این که روزهای پایانی آوریل بازار سنگ آهن وارداتی چین با کمی بهبود قیمت روبرو شد ولی در مجموع ماه گذشته 18 دلار هر تن افت قیمت داشته و با توجه به بهبود قیمت فولاد احتمالا ماه می نیز رشد قیمت هایی در راه است.

آخرین قیمت سنگ آهن خلوص 62 درصد استرالیا در آوریل 1.25 دلار رشد روزانه داشته 68 دلار هر تن سی اف آر ثبت شد که در راستای رشد قیمت فولاد و خبرهای جدید مربوط به کاهش ظرفیت تولید فولاد چین بود. ظاهرا همه فولادسازان در سه شهر استان هبی تا سال 2020 باید خطوط تولید فرسوده را تعطیل کنند. این خبرها قیمت فولاد را بالا برد و بر بازار سنگ آهن اثر گذاشت.

فعالان بازار انتظار دارند حداقل تا اواسط ماه می قیمت سنگ آهن صعودی باشد که به پشتوانه کاهش تولید فولاد خواهد بود. در هر حال تا سال ها نمی توان منتظر رسیدن قیمت سنگ آهن به اوج ماه های نخست سال جاری بود.

منبع: ایفنا

عناوین برگزیده

یک روز پیش

دو روز پیش

سه روز پیش

طلای جهانی از تکاپو افتاد

بازار طلای جهانی اندکی سرد شد

ارزش سهام شرکت فولاد اقلید ۴ برابر شد

صنعت فولاد ایران هدف جدیدترین تحریمهای آمریکا

ساخت ابر پروژه فولاد استان همدان با ۳۰ هزار میلیارد ریال سرمایهگذاری

جزئیات پیشرفت پروژه عظیم مجتمع مس جانجا اعلام شد

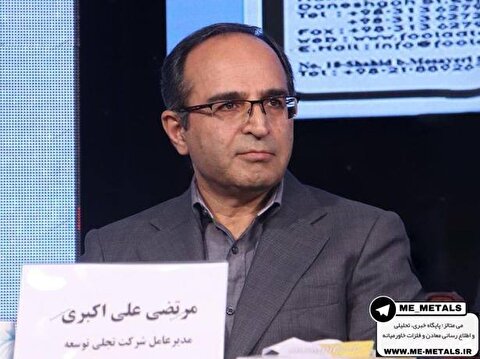

«تجلی» همچنان بر مدار توسعه/ آخرین خبرها از اولین شرکت پروژهمحور بورس

با راهاندازی پروژههای شرکت تجلی توسعه معادن و فلزات در سال جاری

عید واقعی تجلی در سال ۱۴۰۳ اتفاق خواهد افتاد

انعقاد قرارداد همکاری مشترک هلدینگ تجلی با دانشگاه شهید بهشتی

مدیرعامل شرکت ملی صنایع مس ایران در پیامی به مناسبت هفته کار و کارگر:

همت والای کارگران زمینهساز تحقق شعار سال خواهد شد

ترس بازار کریپتو ریخت

تفاهم شرکت ملی صنایع مس و بانک شهر در راستای تامین مالی و توسعه صادرات

جریان گاز در مناطق سیلزده خراسان جنوبی و کرمان پایدار است/ اعزام تیمهای امداد برای خدمترسانی

مقرراتزدایی در نزدیکی کارآفرینها/ قانون هست اجرا خیر

تامین برق مراکز برگزاری آزمون سراسری با موفقیت انجام شد

وزیر کار:

بانکها حق تعطیل کردن بنگاهها را ندارند/ ۱.۲ میلیون نفر بیمه شدند

مشعلهای گازی واحدهای پتروشیمی جمعآوری میشوند

افزایش ۶ برابری مصرف برق با استفاده از کولر گازی در مناطق معتدل

انجام ۲ پرواز به مقصد مدینه منوره

«تجلی» همچنان بر مدار توسعه/ آخرین خبرها از اولین شرکت پروژهمحور بورس

وزیر صمت: شورای رقابت مسوول قیمت پژوپارس است

افزایش قابل توجه صادرات مواد معدنی ترکیه پس از اقدامات انجمن صادرکنندگان مواد معدنی دریای اژه

شتابدهندههای قیمت طلای جهانی کداماند؟/ اثر عوامل سیاسی و اقتصادی بر رشد فلز زرد

طلای جهانی از تکاپو افتاد

بیتکوین آماده شد

فولاد هرمزگان بر مدار رکوردشکنی/ دومین رکورد تولید روزانه تختال به دست آمد

جزئیات پیشرفت پروژه عظیم مجتمع مس جانجا اعلام شد

افتتاح نخستین طرح پیشران اقتصادی کشور با سرمایهگذاری «ومعادن»